Little Known Questions About How To Form A Llc.

In a few states, you should take an additional step to make your company authorities: You need to publish an easy notice in a regional paper, specifying that you intend to form an LLC. You are needed to release the notification a number of times over a period of weeks and after that send an "affidavit of publication" to the LLC filing office.

After you have actually completed the actions described above, your LLC is official. But prior to you open your doors for business, you require to obtain the licenses and allows that all new companies should have to run. These might consist of a business license (sometimes also referred to as a "tax registration certificate"), a federal employer recognition number, a sellers' authorization, or a zoning permit.

A Limited Liability Company is an organisation structure formed under specific state statutes. It is a different legal entity from its owners (referred to as "members"). An LLC can be formed as either a single-member LLC or a multi-member LLC and either member-managed or manager-managed. The LLC is the official business structure that is simplest to form and maintain.

Company owners that are searching for personal liability defense, tax flexibility, and management choices may find that forming an LLC (Limited Liability Business) will be an ideal option for their business. Beside running a business as a sole owner or general partnership, the LLC structure is the least complex and expensive form of organisation to start and maintain from a state compliance viewpoint.

Because an LLC is thought about a separate legal entity from its members, its monetary and legal responsibilities are also its own. So, if someone sues business or the business can not pay its financial obligations, the LLC members are generally not held responsible. For that reason, their individual possessions are at lower danger of being seized to pay legal damages or settle financial obligation than they would be if business were a sole proprietorship or collaboration.

The Main Principles Of How To Form A Llc

As such, income tax is used in the very same method as it is to sole proprietorships and partnerships-- with service income and losses travelled through to its members' income tax return and based on members' specific tax rates. An LLC has other tax treatment options, too. Members can go with an LLC to be taxed as a corporation, with profits taxed at its corporate rate.

An LLC might be either member managed or supervisor handled. In a member-managed LLC, the owners handle the day-to-day management of business. In a manager-managed LLC, members designate several managers to handle the company. In many states, an LLC can select members of the LLC to be supervisors, or it can work with somebody else to do the job.

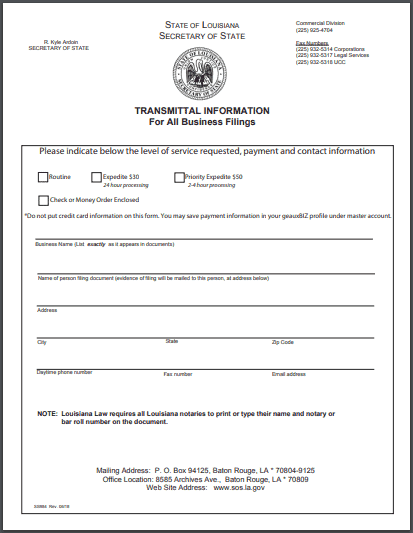

Many states consider an LLC to be member-managed unless the development documents shows it should be manager-managed. Forming an LLC requires filing Articles of Company with the state in which the LLC will run. Corp Net can sign up an LLC in all 50 states to allow them to save time and money-- and to guarantee their documents are submitted properly.

An LLC is needed to have an EIN to open a savings account, declare licenses and licenses, hire workers, and carry out other company activities. An LLC can obtain an EIN for complimentary from the Irs. An organisation can also ask Corp Net to handle completing and sending EIN paperwork on its behalf.

Even in states that do not need operating agreements, an LLC (particularly one has multiple members) might find one useful for preventing misconceptions about who must be doing what and who has the authority to ensure choices. An LLC might require to have view it now numerous organisation licenses and allows to operate in the state or city legally.

Some Known Incorrect Statements About How To Form A Llc

Entrepreneur need to consult the local municipality, county, and state to see what requirements apply to them. Corp Internet can likewise provide additional info about licenses and authorizations. An LLC should keep its financial resources different from its owners. For that reason, it's necessary to open a service bank account and use it just for the purposes of the LLC.

An LLC should also focus on the ongoing compliance requirements it should meet to remain a legal entity in great standing with the state. Compliance obligations vary from one state to the next. Some typical examples of what numerous LLCs require to pay attention to include: Filing taxes Restoring licenses and permits Filing yearly reports with the state Holding member conferences and taking conference minutes Updating the state about substantial modifications in the organisation (e.g., modification in address or including a brand-new member) Choosing a service entity type for your business has both legal and financial implications.

If you've decided that forming an LLC is right for your company, Corp Web is here to assist you manage all of the filings to begin your company and keep it compliant-- in any state! Contact us to conserve you time and money and get the comfort that your filings will be completed accurately, on time, and cost effectively with a 100% guaranteed.

Many small company owners decide to set up an LLC for the liability protection it offers. An LLC, or restricted liability company, exists separately from its owners (referred to as members), and the owners are for that reason not personally responsible for business financial obligations. LLCs are normally easier to establish and more flexible than corporations, and they tend to have fewer continuous reporting requirements.

Every state has its own rules and procedures, but there are numerous steps you'll need to follow to get your LLC up and running, no matter where you live. Step 1: Choosing a Name for Your LLC The majority of states do not allow 2 different organisation entities to have the exact same name.